Finding affordable and comprehensive car insurance in Minnesota presents a significant challenge for many drivers. The state’s no-fault system, while designed to streamline claims, requires careful consideration of coverage limits and potential out-of-pocket expenses. This guide clarifies Minnesota’s minimum requirements and compares leading insurers to help you find the best car insurance MN offers for your needs.

Toc

- 1. Understanding Minnesota’s Minimum Car Insurance Requirements

- 2. Top Car Insurance Companies in Minnesota: A Comparison

- 3. Related articles 01:

- 4. How Much is Car Insurance in MN Per Month? Factors Affecting Your Rate

- 5. Finding Affordable Car Insurance in MN: Tips and Strategies

- 6. Car Insurance Options for Specific Driver Profiles in MN

- 7. Current Trends in the Car Insurance Industry

- 8. Analyzing Customer Feedback on Best Car Insurance MN

- 9. Conclusion

- 10. Related articles 02:

Understanding Minnesota’s Minimum Car Insurance Requirements

Minnesota operates under a no-fault insurance framework, which means that in the event of an accident, each driver’s insurance covers their own medical expenses, irrespective of who is at fault. This system is designed to simplify claims and minimize the need for litigation. However, it is crucial for drivers to familiarize themselves with the state’s minimum insurance mandates.

Minimum Liability Coverage

To comply with Minnesota law, drivers must have minimum liability insurance, which encompasses:

- Bodily Injury Liability (BIL): This coverage is vital if you are at fault in an accident that results in injuries to others. Minnesota mandates a minimum of $30,000 per person and $60,000 per accident for bodily injury liability.

- Property Damage Liability (PDL): This coverage assists in paying for repairs if you damage someone else’s property. The minimum required in Minnesota is $10,000 per accident.

Personal Injury Protection (PIP)

Another essential aspect of Minnesota’s insurance requirements is Personal Injury Protection (PIP). This coverage pays for medical expenses for you and your passengers, regardless of fault, with a minimum coverage of $40,000 per person. PIP can also cover lost wages and other related expenses, making it a critical component of your policy.

Uninsured/Underinsured Motorist Coverage

Having Uninsured/Underinsured Motorist coverage is crucial as well. This protects you in the event of an accident with a driver who either lacks insurance or has insufficient coverage. In Minnesota, approximately 9% of drivers are uninsured, making this coverage particularly relevant.

Nuances of Minnesota’s No-Fault System

While Minnesota’s no-fault system simplifies claims, it does not eliminate the possibility of lawsuits, especially in cases involving serious injuries or significant property damage that exceeds policy limits. In such scenarios, drivers might consider supplemental coverage like Medical Payments (Med-Pay), which can help cover expenses not fully covered by PIP, such as deductibles and co-pays.

Consequences of Driving Without Insurance

Operating a vehicle without insurance in Minnesota can result in severe penalties, including hefty fines, suspension of your driver’s license, and the requirement to file an SR-22 certificate, which proves you have insurance. The repercussions can significantly affect your financial status and driving privileges.

Top Car Insurance Companies in Minnesota: A Comparison

When searching for the best car insurance MN drivers can choose from, several companies emerge as leaders. Understanding the strengths and weaknesses of each can aid you in making a more informed decision.

![]()

State Farm Car Insurance MN

State Farm is among the most recognized names in the insurance industry, offering an extensive range of coverage options and discounts. Their presence in Minnesota is robust, and they are noted for their reliable customer service. Policyholders often appreciate the variety of discounts available, such as safe driver and multi-policy discounts.

Rating: State Farm consistently receives high marks from J.D. Power for customer satisfaction, often ranking at or near the top in claims handling.

However, some reviews suggest that their rates may not always be the most competitive compared to other providers, which is a consideration for budget-conscious consumers.

USAA Car Insurance

USAA is highly esteemed for its customer satisfaction, particularly among military personnel and their families. They offer comprehensive coverage and competitive rates, making them a top choice for eligible individuals.

Rating: USAA frequently earns accolades from AM Best for financial strength and customer service.

However, it is important to note that their services are restricted to military members and veterans, which may exclude a significant portion of Minnesota drivers from considering them.

Auto-Owners Insurance

Auto-Owners Insurance enjoys a strong reputation in Minnesota for its personalized customer service and a broad range of coverage options. Their pricing is often competitive, and they provide unique benefits such as accident forgiveness.

1. https://pcoustic.com/mmoga-finding-the-best-car-crash-lawyer-in-las-vegas-your-ultimate-legal-guide/

2. https://pcoustic.com/mmoga-top-rated-home-and-car-insurance-companies-in-ny/

3. https://pcoustic.com/mmoga-find-cheap-high-risk-car-insurance-a-guide-for-high-risk-drivers/

4. https://pcoustic.com/mmoga-cheap-car-insurance-chicago-your-essential-guide/

5. https://pcoustic.com/mmoga-find-cheap-car-insurance-in-delaware-a-2024-guide/

Rating: According to J.D. Power, Auto-Owners Insurance has received positive ratings for its claims satisfaction.

Nevertheless, some customers have reported slower claims processing times, which could be a drawback for those seeking immediate assistance.

The General Car Insurance MN

The General is particularly known for catering to high-risk drivers, making it a potential option for those with less-than-perfect driving records. Their rates are often more accessible for these individuals, but the range of coverage options may be limited compared to other insurers.

Rating: Customer feedback indicates mixed experiences, with some praising their affordability while others express concerns regarding customer service quality.

Other Notable Companies

In addition to State Farm, USAA, Auto-Owners, and The General, other insurers like GEICO, Progressive, and Nationwide also operate in Minnesota. Each of these companies offers unique benefits and competitive rates, so it is worthwhile to consider multiple quotes to find the best fit for your needs.

How Much is Car Insurance in MN Per Month? Factors Affecting Your Rate

Understanding the factors that influence your car insurance rates is crucial for any Minnesota driver. The average cost of car insurance in Minnesota varies significantly, with some sources citing an average annual cost of approximately $1,200, translating to about $100 per month.

Average Costs

While the average monthly premium may hover around $100, individual rates can vary widely based on personal circumstances and choices. Factors such as driving history, vehicle type, and location can lead to significant differences in costs.

Driving Record

Your driving history significantly impacts your premiums. A clean record with no accidents or speeding tickets typically results in lower rates, while a history of DUIs or at-fault accidents can lead to substantial increases in your insurance costs. For example, a driver with a single speeding ticket might see their monthly premium rise by approximately $100, while multiple incidents could double or even triple rates.

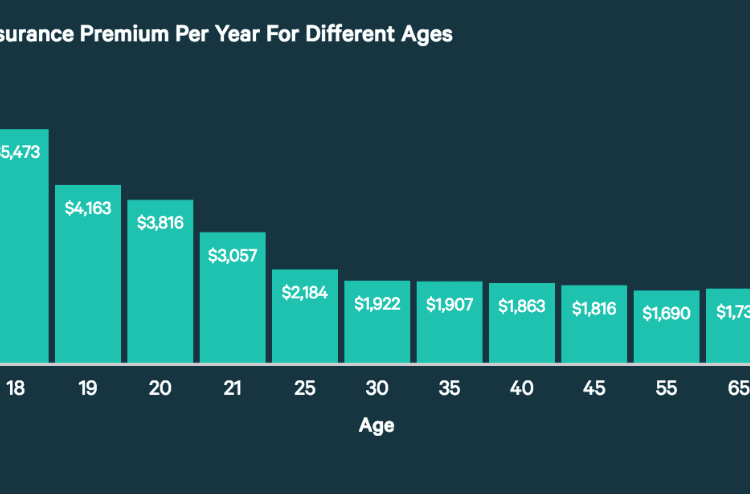

Age and Experience

Insurance providers often consider age and experience when calculating rates. Younger drivers or those with less driving experience generally face higher premiums due to their perceived risk. As drivers mature and accumulate more experience, their rates often decrease, reflecting a lower risk profile.

Vehicle Type

The make and model of your vehicle also play a role in determining your insurance premium. Luxury cars or vehicles known for high theft rates typically incur higher premiums. Conversely, more affordable and safer vehicles may result in lower insurance costs, making it important to consider the type of car you drive when shopping for insurance.

Location

Your geographic location can significantly influence your insurance rates. Urban areas with higher traffic and accident rates typically lead to increased premiums. Conversely, rural areas may offer lower rates due to reduced risk. In Minnesota, cities like Minneapolis and Saint Paul tend to have higher average premiums compared to smaller towns.

Credit Score

While Minnesota has restrictions on the use of credit scores for determining insurance rates, many insurers still consider credit-based insurance scores when available. A better credit score can sometimes yield lower premiums, whereas poor credit may lead to higher costs. This is an important factor to keep in mind as you explore your insurance options.

Impact of Telematics Devices

Many insurers now offer telematics programs, such as Progressive’s Snapshot, that monitor driving habits to help determine premiums. These devices can potentially lower premiums for safe drivers by providing discounts based on actual driving behavior. This trend is gaining traction in Minnesota, as more drivers look to leverage technology for better rates.

Finding Affordable Car Insurance in MN: Tips and Strategies

Securing affordable car insurance is a priority for many Minnesota drivers. Here are some strategies to help you find the best rates.

Discounts

Insurance companies often provide various discounts that can significantly reduce your premiums. Look for options such as:

- Good Student Discount: If you maintain a high GPA, you may qualify for discounts.

- Safe Driver Discount: Drivers with a clean record can often receive lower rates.

- Multi-Vehicle and Multi-Policy Discounts: Bundling your car insurance with other policies, such as home insurance, can lead to substantial savings.

Comparing Quotes

One of the most effective strategies for finding affordable car insurance is to compare quotes from multiple insurers. Every company has different underwriting criteria and may offer varying rates for the same coverage. By obtaining several quotes, you can identify the most competitive options available to you.

A Balanced Perspective on Price vs. Value

While comparison shopping is crucial, it’s essential to recognize that finding the absolute lowest price isn’t always the best strategy. Comprehensive coverage and a reputable insurer with a good claims process can be more valuable in the long run than opting for a marginally lower premium from a less reliable company. Prioritizing quality service and robust coverage can save you time and money in the event of a claim.

Negotiating Rates

Don’t hesitate to negotiate your insurance rates. If you find a better offer from another company, share that information with your current insurer; they may be willing to adjust your premium to retain your business.

Bundling Policies

Consider bundling your car insurance with other types of coverage, such as homeowners or renters insurance. Many companies offer significant discounts for bundling, which can lead to overall savings on your insurance costs.

Insights from Best Car Insurance MN Reddit Discussions

Platforms like Reddit can be valuable resources for real-world insights into car insurance experiences. Many Minnesota drivers share their experiences and recommendations on forums such as Best car insurance MN reddit. Common themes include the importance of thorough research, the benefits of local agents, and the value of understanding your specific coverage needs. Engaging with these communities can provide additional tips and tricks for finding the best insurance options.

Car Insurance Options for Specific Driver Profiles in MN

Different drivers may face unique challenges when seeking car insurance. Understanding available options can help tailor coverage to meet specific needs.

Young Drivers

For young drivers, finding affordable insurance can be particularly challenging. However, options such as taking defensive driving courses or being added to a parent’s policy can lead to significant savings. Many insurers offer special discounts for young drivers who demonstrate responsible behavior.

Drivers with Poor Credit

For those with less-than-perfect credit, securing affordable insurance can be daunting. However, some companies are more flexible with their criteria and may provide reasonable rates despite poor credit. It’s crucial to shop around and explore various options to find the best fit.

Low-Income Car Insurance MN

Minnesota offers resources for low-income individuals seeking car insurance. State assistance programs may help subsidize costs or provide options tailored to those facing financial hardships. It’s advisable to explore these resources if affordability is a concern, especially when considering low-income car insurance MN options.

Drivers with a DUI

Drivers with a DUI on their record may face significant challenges when seeking insurance. Some companies specialize in high-risk insurance policies, making it possible to secure coverage despite a poor record. However, rates will likely be higher, so it’s vital to compare options carefully.

Current Trends in the Car Insurance Industry

Usage-Based Insurance (UBI)

The increasing use of usage-based insurance (UBI) programs is reshaping the car insurance landscape in Minnesota. Many major insurers are now offering UBI options, allowing drivers to receive personalized premiums based on their actual driving behavior. This trend not only encourages safe driving but also provides potential cost savings for responsible drivers.

The Impact of Autonomous Vehicles

As the automotive industry shifts towards autonomous vehicles, the insurance landscape may also change. The introduction of self-driving technology poses unique challenges regarding liability and coverage. Insurers may need to adapt their policies to address the evolving risks associated with these vehicles, potentially leading to new insurance models and pricing structures.

Analyzing Customer Feedback on Best Car Insurance MN

Customer feedback plays a crucial role in assessing the best car insurance providers in Minnesota. Reviews often highlight the importance of customer service, claims handling, and overall satisfaction.

Key Findings from Reviews

A thorough analysis of customer reviews reveals that while some insurers excel in customer service, others may struggle with timely claims processing. Positive experiences often cite effective communication and transparency as significant factors in overall satisfaction. Conversely, negative reviews frequently mention frustrating claims processes and difficulty in obtaining timely responses.

Drivers are encouraged to consider these reviews when evaluating their options. Websites that aggregate customer reviews, such as Best car insurance MN reviews, can provide additional insights into the experiences of fellow Minnesota drivers.

Conclusion

Finding the best car insurance in Minnesota involves careful consideration of your individual needs, driving history, and budget. By understanding Minnesota’s minimum requirements, comparing quotes from multiple reputable companies like State Farm car insurance MN, USAA car insurance (where applicable), Auto-Owners Insurance, and The General car insurance MN, and utilizing the strategies outlined in this guide, you can secure affordable and appropriate coverage.

Additionally, keep an eye on current trends such as usage-based insurance and the potential impact of autonomous vehicles on the insurance landscape. Remember to regularly review your policy and explore available discounts to ensure you are getting the best value for your money. Start comparing quotes today to find the best car insurance MN has to offer.

1. https://pcoustic.com/mmoga-cheap-car-insurance-chicago-your-essential-guide/

2. https://pcoustic.com/mmoga-find-cheap-car-insurance-in-delaware-a-2024-guide/

3. https://pcoustic.com/mmoga-top-rated-home-and-car-insurance-companies-in-ny/

4. https://pcoustic.com/mmoga-finding-the-best-car-crash-lawyer-in-las-vegas-your-ultimate-legal-guide/

5. https://pcoustic.com/mmoga-find-cheap-high-risk-car-insurance-a-guide-for-high-risk-drivers/