Securing affordable car insurance is crucial for drivers in Chicago, a city known for its busy streets and complex insurance market. Finding cheap car insurance chicago requires a strategic approach to navigate the complexities of coverage options and varying costs from different providers. This guide provides a comprehensive framework for finding affordable car insurance in Chicago, empowering budget-conscious drivers to make informed decisions.

Toc

- 1. Understanding Illinois Car Insurance Requirements

- 2. Types of Car Insurance Coverage Explained

- 3. Related articles 01:

- 4. Tips for Reducing Your Car Insurance Costs in Chicago

- 5. The Convenience of Online Car Insurance Options in Illinois

- 6. Related articles 02:

- 7. Current Trends in Chicago Car Insurance

- 8. Addressing Common Questions: Insights from Online Discussions

- 9. Local Car Insurance Providers in Chicago

- 10. Conclusion: Taking Charge of Your Car Insurance Needs

Understanding Illinois Car Insurance Requirements

Navigating the world of cheap car insurance in Chicago doesn’t have to be a complex journey. Illinois law mandates specific insurance requirements that every driver must meet. However, financially responsible drivers can still find affordable coverage that provides comprehensive protection.

Legal Minimum Coverage in Illinois

In Illinois, every driver must carry a minimum level of liability insurance to protect themselves and others on the road. The state mandates the following minimum coverage:

- $25,000 for bodily injury per person

- $50,000 for total bodily injury per accident

- $20,000 for property damage

While these minimums satisfy legal requirements, they often fall short of providing complete financial protection. Financially responsible drivers look beyond these basic limits to ensure comprehensive coverage. Recognizing that the risks associated with driving often require higher coverage limits or additional types of insurance is essential to safeguarding your interests better.

Importance of Additional Coverage

Meeting the minimum requirements may seem sufficient, but it’s essential to recognize that they may not provide adequate protection for your financial security or personal health. Consider the potential costs associated with medical bills, lost wages, and vehicle repairs in the event of an accident. Many drivers opt for higher limits on liability coverage or additional types of insurance, such as collision and comprehensive coverage, to enhance their financial protection.

Penalties for Driving Without Insurance

Driving without insurance in Illinois can lead to significant penalties, including fines, license suspension, and the requirement to file an SR-22 form, which proves that you have insurance. The risks of being uninsured are substantial, making it vital for every driver to ensure they have the necessary coverage.

Types of Car Insurance Coverage Explained

Understanding the various types of car insurance coverage available can help you make informed decisions about your policy. Each type of coverage serves a specific purpose and can impact your overall insurance costs.

Liability Insurance: Your Financial Safety Net

Liability insurance is the minimum requirement and covers damages you may cause to other individuals or their property in an accident. However, it does not cover your own vehicle or medical costs. This type of insurance is crucial, especially in a bustling city like Chicago, where the risk of accidents is higher due to traffic congestion and varying road conditions.

Collision Insurance: Protecting Your Vehicle

Collision insurance pays for damage to your car resulting from a collision with another vehicle or object. This type of coverage is particularly important if you are financing or leasing your vehicle, as lenders typically require it. However, it can increase your premium, so weigh its necessity based on your financial situation. For instance, if you own an older vehicle, consider whether the cost of this coverage is justified compared to the car’s value.

Comprehensive Insurance: Coverage Beyond Collisions

Comprehensive insurance offers broader protection against non-collision-related incidents such as theft, vandalism, and natural disasters. This coverage can protect your vehicle from various unexpected events, from hail damage to theft, which can be a concern in urban areas. While it provides peace of mind, it also comes with additional costs. Evaluating whether this coverage is essential for you depends on factors like the age and value of your vehicle, as well as your location and driving habits.

Uninsured/Underinsured Motorist Coverage: Essential Protection

This coverage protects you when involved in an accident with a driver who either lacks insurance or has insufficient coverage. Given the number of uninsured drivers on the road, this type of coverage is critical for your safety and financial well-being. In many cases, it can save you from significant out-of-pocket expenses following an accident caused by an underinsured driver.

1. https://pcoustic.com/mmoga-best-car-insurance-mn-a-comprehensive-guide/

2. https://pcoustic.com/mmoga-find-cheap-high-risk-car-insurance-a-guide-for-high-risk-drivers/

3. https://pcoustic.com/mmoga-find-cheap-car-insurance-in-delaware-a-2024-guide/

4. https://pcoustic.com/mmoga-top-rated-home-and-car-insurance-companies-in-ny/

5. https://pcoustic.com/mmoga-finding-the-best-car-crash-lawyer-in-las-vegas-your-ultimate-legal-guide/

Medical Payments Coverage and Personal Injury Protection

Medical payments coverage, often abbreviated as Med-Pay, helps cover medical expenses for you and your passengers after an accident, regardless of fault. Personal Injury Protection (PIP) expands this coverage to include lost wages and other related expenses. While these coverages are optional, they can provide significant financial relief in the aftermath of an accident. If you frequently drive with passengers or if you have health insurance that might not cover certain expenses, considering these options could be beneficial.

Tips for Reducing Your Car Insurance Costs in Chicago

Securing cheap car insurance in Chicago involves more than just shopping around. Here are several strategies that can help you lower your premiums effectively.

Compare Quotes from Multiple Providers

Obtaining quotes from several insurance companies is a crucial step. Different insurers offer varying rates for similar coverage, so comparing them can reveal significant savings. Online resources can help streamline this process, allowing you to evaluate quotes from multiple providers, including Liberty Mutual and State Farm car insurance. Many websites allow you to input your information once and receive quotes from several companies, making it easier to find the best deal.

While online comparison tools are invaluable, remember that the “cheapest” quote isn’t always the best. Insurers use sophisticated algorithms to determine rates, and factors like age, credit score, and driving history significantly impact pricing. For example, a young driver with a few minor infractions might find better rates with a company that specializes in high-risk drivers, even if a comparison website shows another insurer as having the lowest initial quote.

However, spending excessive time comparing quotes might not be worth the small potential savings, especially if you find a good rate early in the process. Focus on obtaining a few quotes, then weigh the coverage benefits and costs before making a decision.

Explore Discounts and Savings Opportunities

Many insurance companies provide discounts that can substantially lower your premium. Safe driver discounts, good student discounts, and multi-car discounts are just a few options available. Some insurers may advertise potential savings of up to 25%, so it’s worth inquiring about all possible discounts when obtaining quotes. Additionally, consider asking about discounts for features such as anti-theft devices or safety features in your vehicle.

Understanding Deductibles

While raising your deductible may initially seem counterintuitive, it can lower your monthly premiums. A higher deductible means you will pay more out-of-pocket in the event of a claim, but it can significantly reduce your overall insurance costs. For instance, increasing your deductible from $500 to $1000 might save you $10-$20 per month, but you’ll have to pay $500 more out-of-pocket in the event of a claim. Carefully weigh the potential savings against your ability to absorb a higher deductible.

However, drivers with limited savings should prioritize lower deductibles to avoid financial hardship in case of an accident. This decision ensures you won’t face overwhelming costs after an incident, even if it means paying slightly higher premiums.

The Impact of Driving Record

Your driving history directly impacts your insurance rates. Maintaining a clean driving record without accidents or violations can lead to lower premiums over time. Insurance companies view safe drivers as lower risk, and many reward them with reduced rates.

Participating in defensive driving courses can sometimes lead to discounts, and some insurers may provide incentives for enrolling in these programs. However, it’s essential to recognize that points on a driving record can translate into increased premiums. The impact of points varies by insurer and state but generally involves a significant increase in premiums for accidents and moving violations.

Moreover, even careful drivers can be involved in accidents beyond their control. It’s important to remember that a single incident can impact your rates, but demonstrating a long-term commitment to safe driving can help mitigate this risk.

Improve Your Credit Score

In some states, insurers consider your credit score when calculating premiums. While this practice may not apply everywhere, improving your credit score can potentially lead to lower rates. Monitoring your credit regularly and taking steps to enhance it, such as paying bills on time and reducing credit card balances, are effective ways to improve your creditworthiness. This improvement can help you secure better insurance rates, contributing to your overall savings.

The Convenience of Online Car Insurance Options in Illinois

Purchasing car insurance online can offer both convenience and cost savings. Many drivers prefer the ease of comparing policies and obtaining quotes from the comfort of their homes.

1. https://pcoustic.com/mmoga-find-cheap-high-risk-car-insurance-a-guide-for-high-risk-drivers/

2. https://pcoustic.com/mmoga-top-rated-home-and-car-insurance-companies-in-ny/

3. https://pcoustic.com/mmoga-find-cheap-car-insurance-in-delaware-a-2024-guide/

4. https://pcoustic.com/mmoga-best-car-insurance-mn-a-comprehensive-guide/

5. https://pcoustic.com/mmoga-finding-the-best-car-crash-lawyer-in-las-vegas-your-ultimate-legal-guide/

Advantages of Online Insurance Shopping

Reputable online comparison sites allow you to review various policies from different providers, ensuring you find the cheapest car insurance in Illinois. While shopping online, it’s essential to remain vigilant about data privacy and security. Make sure to use trusted sites and read the privacy policies to understand how your information will be used.

You can easily access options for “cheap online car insurance Illinois,” enabling you to make informed decisions without the pressure of a sales representative. Many companies now offer instant quotes online, allowing you to get a sense of your potential rates quickly.

Recommended Online Comparison Tools

- Insurify: Compares quotes from various providers.

- The Zebra: Offers a wide range of options and insights.

- NerdWallet: Provides detailed reviews and comparisons of insurance policies.

Current Trends in Chicago Car Insurance

The car insurance landscape in Chicago is evolving, influenced by technological advancements and changing consumer preferences. Here are some current trends to keep in mind:

Telematics-Based Insurance (Usage-Based Insurance)

Telematics-based insurance is gaining popularity as it allows insurers to monitor driving behavior through devices installed in vehicles or smartphone apps. This data can provide discounts for safe driving practices, rewarding responsible drivers with lower premiums. For example, drivers who exhibit safe habits like smooth braking and acceleration may see significant reductions in their insurance costs.

Pay-Per-Mile Insurance

Usage-based insurance options, such as pay-per-mile insurance, are increasingly adopted in urban areas like Chicago. This model reflects actual driving habits, allowing drivers who use their vehicles less frequently to save on premiums. This is particularly beneficial for individuals who rely on public transportation or only use their cars for occasional trips.

Addressing Common Questions: Insights from Online Discussions

The internet is rife with discussions about car insurance, especially on platforms like Reddit. Here are some common questions and concerns along with factual answers:

- Is car insurance required in Chicago? Yes, all drivers in Chicago must carry insurance as mandated by Illinois law. This requirement is in place to protect all road users and ensure financial responsibility.

- Can insurance companies drop you? Insurance providers can cancel your policy under specific circumstances, such as non-payment or providing fraudulent information. It’s crucial to maintain open communication with your insurer to avoid misunderstandings that could lead to policy cancellation.

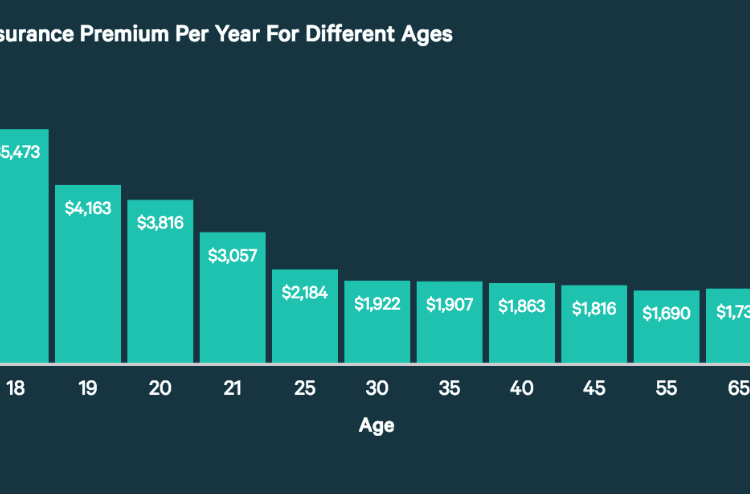

- What is the average cost of car insurance in Illinois? As of 2024, the average annual cost of car insurance in Illinois is approximately $1,982, which is lower than the national average. However, individual costs can vary widely based on factors like age, driving history, and location.

- What does Chicago auto insurance not cover? Common exclusions include intentional damage, normal wear and tear, and personal belongings within the vehicle. Understanding these exclusions can help you make informed decisions about additional coverage options or taking extra precautions.

Local Car Insurance Providers in Chicago

While numerous national companies operate in Chicago, local insurance providers can offer personalized service that may suit your needs better. Here are a few notable options:

- United Auto Insurance: Established for over 50 years, this company provides tailored coverage options for drivers in the Chicago area. Their long-standing presence in the community means they understand local needs and can offer relevant advice.

- Oxford Auto Insurance: Known for its affordability, Oxford offers various policies designed to meet both minimum requirements and additional coverage needs. Their customer service focus ensures that clients receive personalized attention when selecting their policies.

For personalized service, consider reaching out to local agents who can assist you in navigating your insurance options. Working with a local agent can provide insights into the specific risks associated with driving in your neighborhood, potentially leading to better coverage choices.

Conclusion: Taking Charge of Your Car Insurance Needs

Finding cheap car insurance in Chicago is attainable with thoughtful planning and diligent comparison. By understanding your coverage needs and taking advantage of available discounts, you can secure a policy that meets your financial constraints without compromising essential protection. The importance of being well-informed about different types of coverage, legal requirements, and strategies for savings cannot be overstated.

Start by comparing quotes today, and take the first step toward securing the best deal on car insurance that suits your lifestyle and budget. Whether you choose to work with a local agent or explore online options, being proactive in your search can lead to significant savings and peace of mind on the road.